Introduction

This guide explains how to run the calculator—inputs, estimate breakdown, legal checks, and PDF export.

1) Filling Vehicle Details

Required fields are marked with *. Optional fields (VIN, Mileage, etc) improve accuracy and the legal checks.

For motorcycles, provide engine cc. For pickups/trucks, provide GVWR.

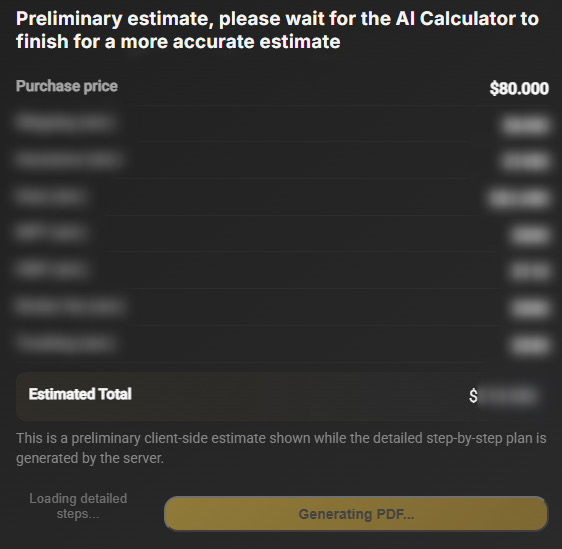

2) Running the Estimate

Click Calculate. You’ll see a progress bar and a preliminary client-side estimate while the server finalizes the detailed plan using deterministic rules + AI narration.

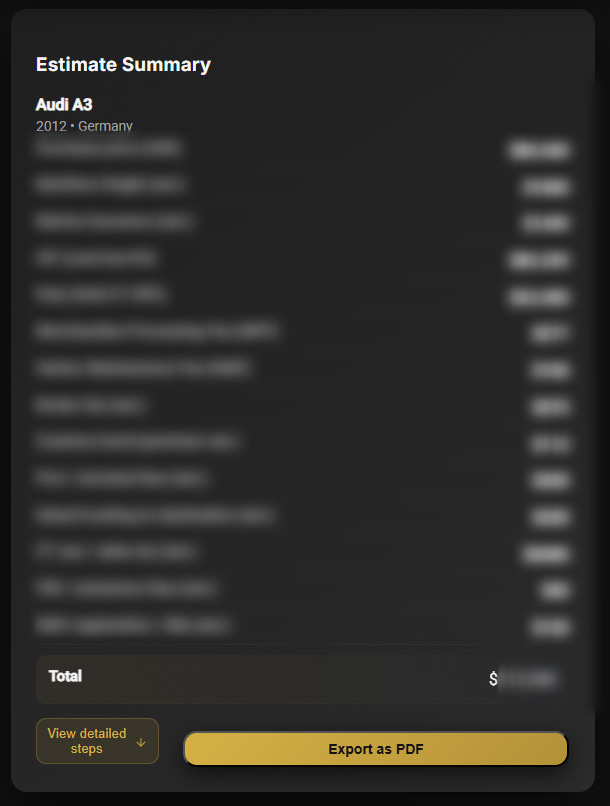

3) Interpreting Results

Each estimate is a structured cost breakdown showing every major component involved in importing your vehicle — from purchase value and international shipping to U.S. Customs duties, processing fees, inland transport, and state-level items. Each item in the breakdown includes a clear label and amount;

We are implementing an interactive chatbot assistant able to explain every cost in depth — duties, bonds, local taxes, EPA/DOT forms and exemptions — and walk you through the reasoning behind each number, as well as answering your questions like an expert. Let us know if you’d be interested in early access at support@carlux-import.com.

4) Step-by-Step Plan

Scroll to the Steps section to see each action from export documents to U.S. registration. Click a card to read the details. Use the arrows to navigate horizontally.

EPA Form 3520-1 and DOT HS-7 are typically required for vehicles; your plan will flag them.

5) Exporting to PDF

Use Export as PDF to download a branded report including inputs, breakdown and the step-by-step plan.

FAQ

- Is this tool official? No — it’s for informational purposes only.

- Do I need a customs broker? Not legally required, but absolutely recommended for compliance.

- Why numbers vary? Exchange rates and fees change.

Need help? Contact support.